Operating Vs Finance Lease (Key Differences Defined)

페이지 정보

본문

With a totally-Maintained Working Lease, the working prices - including registration, servicing and tyres - are bundled into one month-to-month cost. The lessor オペレーティングリース リスク will take into consideration how many kilometres you drive and how long you plan on leasing the automobile when calculating the month-to-month cost. At the top of the lease interval, the car is returned to the lessor and ownership cannot typically be transferred to the lessee. Which means that the lessor additionally takes on the residual value risk of the automobile, equivalent to adjustments within the car’s worth and fluctuations in market situations. Absolutely-Maintained Working Leases are a extremely popular method for businesses seeking to finance their car fleets - or perhaps a single automobile. Working Leases are an admin-free approach for companies to manage tasks like rego renewal and insurance coverage, as these are dealt with by the lessor.

This method can be utilized to depreciate assets the place variation in usage is an important issue, reminiscent of cars based mostly on miles pushed or photocopiers on copies made. Under is a video tutorial explaining how depreciation works and the way it impacts a company’s three financial statements. Accountants use the straight line depreciation method as a result of it's the easiest to compute and might be utilized to all lengthy-time period assets. However, the straight line technique does not accurately reflect the difference in usage of an asset and is probably not probably the most acceptable value calculation method for some depreciable property. For instance, because of rapid technological developments, a straight line depreciation method will not be suitable for an asset reminiscent of a pc. A pc would face larger depreciation expenses in its early helpful life and smaller depreciation bills in the later periods of its useful life, as a result of the fast obsolescence of older know-how. It would be inaccurate to assume a computer would incur the identical depreciation expense over its entire helpful life. Depreciation expense isn't an asset and accumulated depreciation isn't an expense. Depreciation expense is reported on the earnings statement just like another regular business expense. The expense is listed in the working expenses space of the earnings assertion if the asset is used for production. This quantity reflects a portion of the acquisition value of the asset for manufacturing purposes. Factory machines which might be used to supply a clothing company's main product have attributable revenues and costs. The corporate assumes an asset life and scrap value to find out attributable depreciation.

Altering strategies should only be accomplished if it outcomes in additional acceptable or dependable financial reporting. Consistency in your approach helps stakeholders better perceive your monetary place over time. By carefully contemplating these factors, you may choose the depreciation technique that most closely fits your business needs, accurately displays the worth of your property, and aligns with your monetary goals. Remember, whereas you've gotten flexibility in selecting a technique, it’s essential to use it persistently and in compliance with relevant accounting requirements and tax regulations. What is an working lease? Finance leases and operating leases are two frequent kinds of lease preparations that companies encounter. With the introduction of the ASC 842 accounting normal, the classification and treatment of leases have advanced. On this blog publish, we are going to delve into the distinctions between finance leases and operating leases and talk about how ASC 842 impacts the accounting for these lease varieties. Although the lease is typically non-cancellable by the lessee, ought to the aircraft undergo a casualty, the lessee is required to pay the lessor the agreed value of the aircraft, determined at lease inception. Other than a casualty, some financing leases may additionally permit the lessee to terminate the lease and purchase the aircraft from the lessor or in any other case make the lessor complete.

From time-to-time, transactions or scenarios occur that require consideration of whether or not an operating lease or a finance lease is the easiest way ahead for events involved. Whilst the buildings are similar, from a legal perspective, there proceed to be key differences in how operating and finance leases are structured and function. Traditionally, the 2 obtained totally different accounting remedy, with operating leases being successfully off-balance sheet. This, nonetheless, modified with the introduction of IFRS sixteen in 2019, with that distinction in accounting therapy ceasing to apply. An operating lease is traditionally described as an aircraft rent contract between the lessor (as owner) and a lessee (i.e. an airline) for the agreed term, which is normally now not than 12 years. The lessor leases the aircraft to the lessee; the lessee pays (amongst other things) rent and at the top of the time period, the aircraft is returned to the lessor. Below this construction, the ownership (and residual value) danger will remain with the lessor with working leases, also together with more stringent maintenance and insurance necessities than finance leases in order to guard the aircraft’s worth.

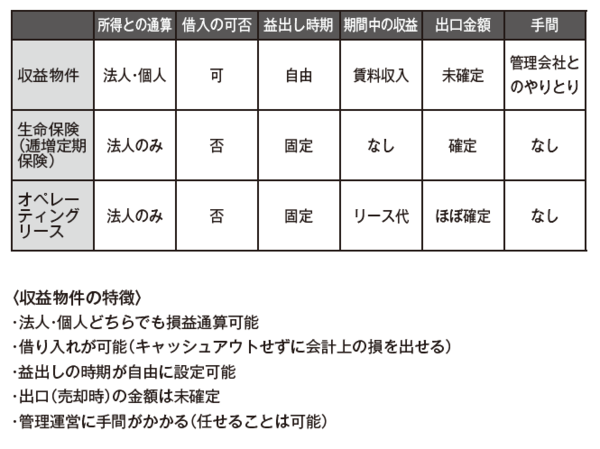

To accurately determine the tax base, companies should consider numerous elements, together with asset valuation and entity classification. In managing multistate tax obligations, apportionment and allocation play a key role in determining the taxable revenue of a company, as they involve the division of earnings amongst states based mostly on specific components. When considering leasing property for your enterprise, it’s necessary to know the variations between working leases and finance leases. Factors reminiscent of cash move management, balance sheet implications, asset administration, tax benefits, and maintenance tasks ought to all be taken into consideration when choosing the right lease possibility. Operating leases provide benefits akin to decrease costs, quick-time period commitment, and not having ownership tasks. Nevertheless, they even have disadvantages, together with not gaining equity and the potential for paying greater than market value.

- 이전글Get Your Jackpot! 24.12.28

- 다음글What Are The 5 Fundamental Benefits Of Gold In Germany 24.12.28

댓글목록

등록된 댓글이 없습니다.