Working Lease: The Strategic Position Of Working Leases In Capital Fun…

페이지 정보

작성자 Meredith 작성일 24-12-27 23:47 조회 3 댓글 0본문

However, capital leases, also referred to as finance leases, are more like buying an asset with a mortgage. The lessee records the asset on their stability sheet and assumes each the risks and rewards of possession, which includes depreciation and potential tax benefits. From an accounting perspective, these two varieties of leases are handled in another way. Working leases don't appear as property or liabilities on the stability sheet, leading to a lower debt-to-equity ratio, which might be enticing to investors. Conversely, capital leases increase each belongings and liabilities, affecting leverage ratios and doubtlessly impacting a company's borrowing capacity. 1. Initial Outlay: Working leases typically require much less upfront capital, making them a viable option for companies with restricted money reserves. For example, a small business may go for an working lease to acquire a fleet of delivery autos, thereby preserving capital for other operational wants. 2. Asset Possession: At the top of a capital lease, the lessee normally has the choice to buy the asset at a bargain price, effectively transferring possession.

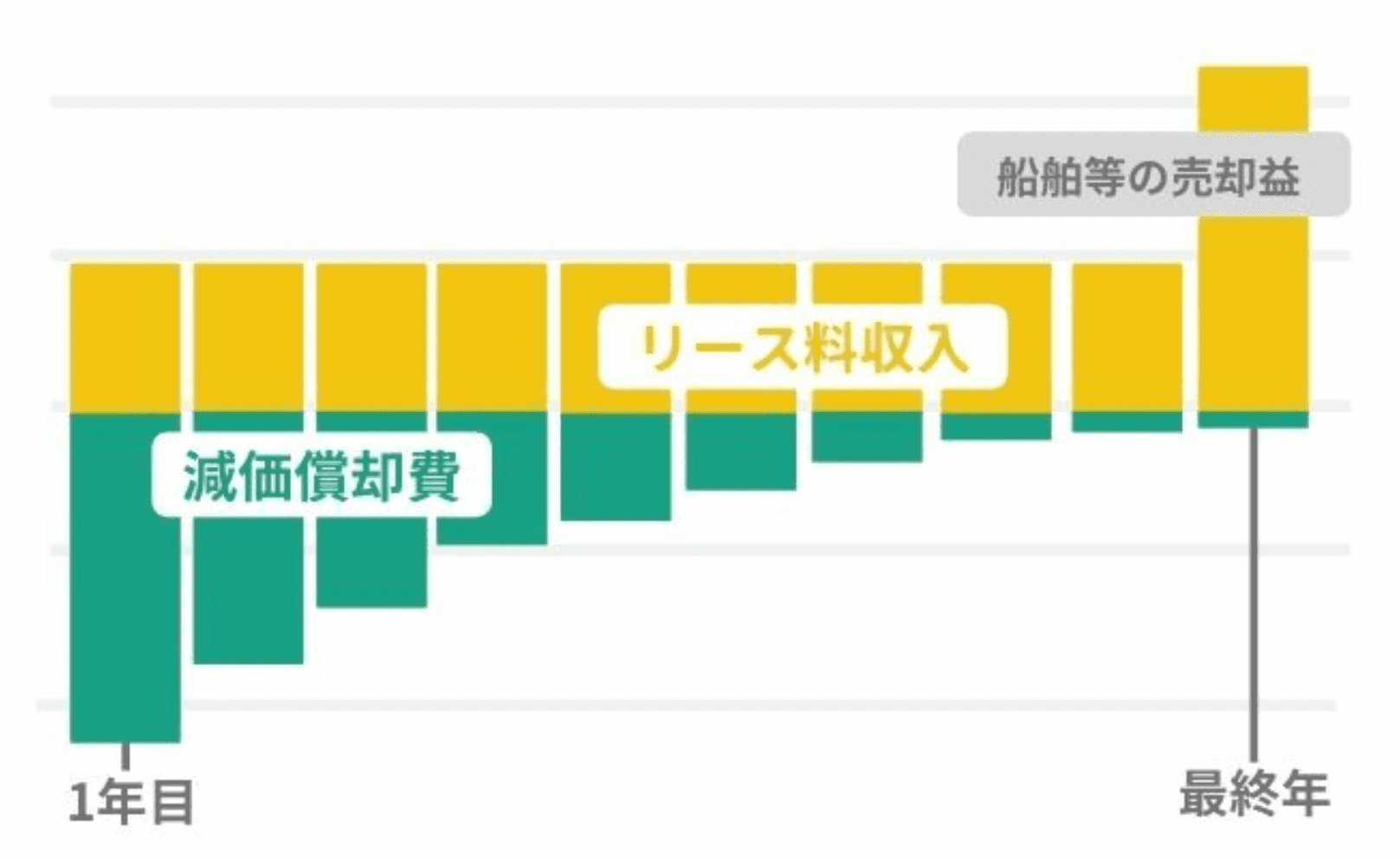

Non-Money Expense: Importantly, depreciation is a non-money expense. Because of this the company would not really spend cash when it information depreciation. Instead, it reflects the gradual "using up" of the asset's value over time. Regardless of not involving money outflow, it still impacts the revenue assertion by reducing reported profit. Depreciation on an revenue assertion is like spreading out the price of things a company owns, オペレーティングリース 節税スキーム like buildings or machines, over time. It isn't actual money spent, but it exhibits how a lot these items have worn down or change into much less valuable over their useful life. This helps in understanding how a lot a company actually made in a certain time period, although it would not instantly have an effect on how a lot money they've.

Aircraft leasing corporations are investing in more gas-efficient aircraft and exploring alternative fuels to cut back carbon emissions. This development is expected to continue in the future, with aircraft leasing firms focusing on environmental sustainability. Emerging markets akin to Asia and Africa are experiencing rapid financial development, and the aviation business is following swimsuit. Aircraft leasing companies are expanding their operations in these markets to meet the growing demand for air journey. This trend is anticipated to continue in the future, with aircraft leasing corporations specializing in rising markets. Aircraft lease management entails leasing an aircraft from a lessor and managing the lease throughout its duration. Lessees could even be subject to tax on the lease funds they make, depending on their jurisdiction and the phrases of the lease settlement. To make sure compliance with these regulations, lessors and lessees are required to take care of accurate data and submit regular stories to the related authorities. This contains offering information on the ownership and registration of the aircraft, in addition to details of the lease agreement and any associated monetary transactions. Total, the regulatory framework for aircraft leasing is designed to advertise security, security and transparency in the industry.

Financial ratios could also be enhanced, and borrowing might turn out to be easier, as a result. 6. Upkeep and Support: Lease agreements might specify that the lessor pays for upkeep, repairs, and other bills concerning the leased property. This absolves the lessee of those extra costs and obligations. 7. Smarter Asset Management: Leasing enables firms to handle their property successfully. At the end of the lease, they may simply replace, change, or eliminate them, saving them the difficulty of ownership. Thus, the leasing company does not lose a lot of money after a re-sale. If a lessor can not discover a purchaser, they will just scrap the aircraft for elements. There may be always an aftermarket for spare parts. Whereas it may not recover the identical amount of money, the company still retains some of the worth of an aircraft. A collateral relative (brother, uncle …) of the deceased who has lived with him through the 2 years prior to the dying. That the acquisition of the habitual residence is maintained during the 3 years following the demise. The reduction of the Inheritance Tax in Andalusia for the switch of a company or business is improved compared to the state one. A 99% reduction is ready in the tax base.

Enterprise aims additionally play a job in the choice of depreciation technique. A new enterprise looking for to minimize taxable revenue in its formative years might go for an accelerated technique to scale back internet earnings early on. Conversely, a mature firm targeted on reporting steady earnings progress might prefer the straight-line technique to smooth out expenses over time. For instance, a development equipment firm can lease its equipment to contractors, and keep away from the prices and dangers of repairing or replacing the tools if it breaks down or will get damaged on the job site. Three. Asset administration: Asset leasing can allow lessors to optimize the utilization and efficiency of their property, and increase their value and lifespan.

댓글목록 0

등록된 댓글이 없습니다.